[ad_1]

Watching components of the World Sequence Recreation (Main League Baseball) final evening, I could not assist however discover the heavy promoting for Google Cloud, owned by Alphabet (GOOG), (GOOGL). It appeared not too far within the distant previous that it was Amazon’s (AMZN) AWS with heavy sponsorship of the analytical-type replays and evaluation for each the MLB and NFL. Whereas clearly fully anecdotal, easy observations like these could be telling notably if the numbers again up a altering pattern. Within the case of the Cloud Wars, it looks like Google is wildly spending to meet up with AWS and Microsoft’s (MSFT) Azure. Current Money Circulation Assertion numbers additionally again up that declare (tens of billions), and it is by a scale of just about 2:1.

I am going to take a deep dive into these capital expenditure numbers of the large cloud gamers, however first let’s evaluate how GOOG’s cloud section has executed currently. From the corporate’s newest 10-q:

- Google Cloud Income for the Quarter (ended June 30)

- $three,zero07 million

- +43.2% YOY

- Google Cloud Income for the 6 Months (ended June 30)

- $5,784 million

- +47.four% YOY

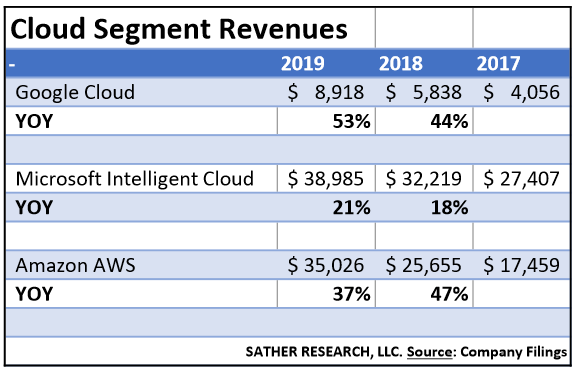

The long-term pattern of those revenues is most fascinating to me, as we’ll evaluate to opponents and capital expenditures:

Observe that Microsoft’s newest income numbers for Clever Cloud have been $48,366 million for 2020, just lately launched of their 10-k for Fiscal Yr 2020 ended June 30, 2020 with its totally different schedule in comparison with GOOG’s (and Amazon’s) Fiscal Yr reporting in its 10-k.

With Microsoft’s progress slowing down and Google’s dashing up, there might be some room for the catching-up that GOOG is searching for to be a serious participant on this area. We are able to see that although the expansion price on a proportion foundation is far sooner, Microsoft’s Cloud and AWS each grew on a nominal foundation greater from 2018 to 2019 ($6B and $10B respectively), and so these firms are capturing a disproportionately bigger quantity of free money flows from their segments regardless that GOOG has the upper proportion progress (that is compounding at work).

With Microsoft’s progress slowing down and Google’s dashing up, there might be some room for the catching-up that GOOG is searching for to be a serious participant on this area. We are able to see that although the expansion price on a proportion foundation is far sooner, Microsoft’s Cloud and AWS each grew on a nominal foundation greater from 2018 to 2019 ($6B and $10B respectively), and so these firms are capturing a disproportionately bigger quantity of free money flows from their segments regardless that GOOG has the upper proportion progress (that is compounding at work).

However to not be discouraged, GOOG has additionally ramped up its already excessive capex spending in recent times, which is smart in accordance with the variety of information facilities they presently have (publicly reported as 21 just lately), in comparison with MSFT and AMZN (who aren’t as upfront about their variety of information facilities however I estimate it every at rather less than 50 and 100 respectively, primarily based on back-of-the-napkin math and a few affordable common estimates on sq. footage and services utilization).

I wrote an article concerning the bodily limitations of knowledge facilities (the impression of the cloud on firm steadiness sheets) and the way the rise in information era and consumption means actual, tangible, chilly exhausting money investments (capital expenditures).

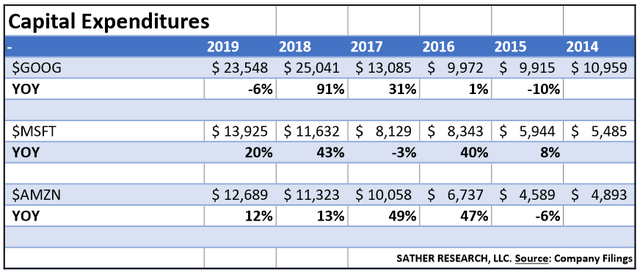

Capital Expenditures (Together with Cloud Spend)

Here is a abstract of these capital expenditures for these three gamers over the past 5 years:

Of be aware particularly is the compounded annual progress price for every of those over the past 5 years, because the YOY numbers are jumpy. I calculated that as the next.

Of be aware particularly is the compounded annual progress price for every of those over the past 5 years, because the YOY numbers are jumpy. I calculated that as the next.

- GOOG = +16.5% 5y CAGR

- MSFT = +20.5% 5y CAGR

- AMZN = +21.zero% 5y CAGR

These numbers aren’t good representations, however they get the job executed for traders attempting to understand the true potential of cloud spend, as that trickles all the way down to the elevated spend on colocation for the info middle REITS (EQIX), (DLR.PK), (CONE), and the community and servers gear makers (CSCO), (IBM), (ANET), (INTC), and even oblique electronics suppliers (TEL), (APH), and on and on.

For GOOG, the heavy capex has now dwarfed Microsoft and must be required in the event that they wish to take their information middle community attain from the present degree of round 20 to the 50-100 degree that MSFT and AMZN have. The additional tens of billions spent within the final two fiscal years ought to’ve helped shut the hole already; do not be stunned to listen to of extra information facilities which have popped up and begin to add additional capability and revenues to the Cloud section.

Administration’s ideas on capex via the pandemic (and one thing to look at within the upcoming convention name; bolded emphasis mine):

Money CapEx for the quarter was $5.four billion… Google accrued CapEx for the quarter was $four.eight billion, reflecting investments in servers, information facilities and workplace services… Turning to CapEx. We proceed to count on a modest lower within the degree of complete CapEx in 2020 in contrast with final 12 months. That is notably attributable to our determination to gradual the tempo at which we purchase workplace buildings within the close to time period as we deal with reimagining the optimum work atmosphere. This additionally displays the slower tempo of ground-up building for each our workplace services and information facilities attributable to COVID-19.

So whereas the “meals chain” quoted above is more likely to see continued long-term progress from GOOG in the way in which of their information middle spending wants (to atone for a services degree), there may be some hiccups within the quick time period which could not be mirrored in present earnings outcomes being launched right here in the previous few weeks of October 2020.

Two Current Tailwinds for Google Cloud Which Ought to Proceed

From the corporate’s newest convention name, CEO Sundar Pichai had this to say (tailwind #1):

First, the way forward for enterprise can be extra digital. Prospects are selecting Google Cloud to both decrease their price by enhancing working effectivity or to drive innovation via digital transformation. Manufacturers like Keurig Dr. Pepper, Deutsche Financial institution, Lowe’s, Telefónica, Orange and Group Renault. And we’re serving to many authorities businesses ship care for his or her residents…

I believe this one is a no brainer that surprises no person, and is a tailwind for each firm within the area. One factor of this that perhaps has caught some individuals abruptly is the shift to digital not solely by firms and companies, but in addition in political advert spend, as reported by In search of Alpha as political spending reached a document $6.7B, with digital at an 18% share. Whereas not a direct circulate via to the corporate’s Cloud section, the transformation to digital over time leaks into all elements of many firms’ enterprise fashions, making that spend an rising precedence shifting ahead.

The 2nd tailwind because it pertains to GOOG:

Second, the way forward for work can be extra collaborative… In Q2, we noticed continued demand from clients utilizing G Suite to assist their workers earn a living from home, together with Wipro in India and expanded our relationship with the state of Arizona right here within the U.S… In Q2, we peaked at greater than 600 million Meet members in a single week.

The stickiness of enterprise cloud and thus large pricing energy that is accompanied with these varieties of associated merchandise powers the info middle/ cloud tailwinds, as a rising tide lifts all boats. Keep in mind additionally that the G Suite set of merchandise will get acknowledged within the Google Cloud section, and will carry related tailwinds to extra just lately “sizzling” productiveness names like Zoom (ZM).

GOOG, GOOGL Valuation Estimate

Now I’ll study the place Wall Avenue is pricing Alphabet’s progress potential available in the market right this moment utilizing a reverse DCF. For this reverse DCF, I can be assuming a reduction price of 7%. Although in my newest articles I have been utilizing a reduction price of 6%, the 10y Treasury has been on an uptrend and is approaching pre-pandemic ranges (right this moment at zero.82%). With Alphabet’s present WACC (weighted price of capital) at 7.31%, this looks like an affordable estimate proper now.

I’ll present two free money circulate estimates, one for TTM and one for FY 2019:

- FCF = $42.99 per share, Implied progress = 16.6%

- FCF = $44.34 per share, Implied progress = 16.2%

GOOG is presently priced for very excessive progress within the years to come back. If the ability of cloud actually does carry out like many analysis companies project– CAGRs of 20-25%+ for spending, PaaS markets, information consumption and so on.– then traders paying this worth may win out ultimately.

It actually relies on the way you see the long run progress of not solely Alphabet, however its bets on the Cloud (and “Different Bets”). When future progress is excessive, then compounding can overcome virtually all kinds of obscenely excessive valuations. But when that prime double digit progress does not materialize… be careful beneath.

***If you would like extra deep dives into firm filings like this one, please do take into account Following my profile with e-mail alerts. To see how my picks for the Actual Cash Portfolio have executed, take a look at: Put up-Pandemic Efficiency***

Disclosure: I’m/we’re lengthy MSFT, CSCO. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from In search of Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.

[ad_2]

Source link