[ad_1]

Robinhood traders have a repute for purchasing high-growth shares. Certainly, a number of the hottest shares on the platform match that description, together with Virgin Galactic Holdings, Penn Nationwide Gaming, and Tesla.

Nonetheless, no fewer than seven exchange-traded funds, or ETFs, seem in Robinhood’s present Prime 100 record. Whereas hundreds of thousands of Robinhood traders are definitely making an attempt to get in on the bottom ground of the subsequent massive factor, many are additionally creating sensible, low-maintenance, long-term funding portfolios with the magic of index funds.

In the event you’re on the lookout for some investments that might produce glorious long-term returns whereas nonetheless permitting you to sleep soundly at evening, listed here are three glorious ETFs.

Picture supply: Getty Photographs.

One of the crucial thrilling tech traits

The best way we pay for items and providers has radically reworked over the previous decade or so, and can probably proceed to take action. Monetary expertise contains fee processing firms like Sq. and PayPal, monetary software program firms like Intuit and Invoice.com, and corporations that make it simpler and more cost effective to borrow cash like LendingTree, simply to call just a few.

As an alternative of making an attempt to choose winners within the house, it could be a greater concept to easily notice that “a rising tide lifts all ships” and put money into all the fintech leaders. The World X FinTech ETF (NASDAQ: FINX) does simply that. Its portfolio incorporates 33 of essentially the most compelling fintech shares, together with the 5 firms talked about within the final paragraph, in addition to a number of the most enjoyable internationally listed fintech leaders that will not be obtainable via Robinhood.

With a zero.68% expense ratio, the World X FinTech ETF is not low cost, nevertheless it is not too steep of a value to pay for an all-in-one portfolio that might profit from one of the thrilling development markets of this technology.

Get wealthy slowly with dividends

With rates of interest close to file lows, discovering investments that pay a good yield with no ton of threat could be difficult. Vanguard Excessive Dividend Yield ETF (NYSEMKT: VYM) is one in all a uncommon few.

This fund invests in a various portfolio of greater than 400 shares that pay above-average dividends. Prime holdings embrace Johnson & Johnson, Procter & Gamble, and JPMorgan Chase. These shares are stable funding decisions on their very own, nevertheless it might be a fair higher concept to personal all of those excessive yielders as a part of an ETF.

The Vanguard Excessive Dividend Yield ETF has a dividend yield of about four.three% as of this writing and has a rock-bottom zero.06% expense ratio. This is not simply an revenue play; over the previous decade, the fund has generated complete returns averaging over 11% per 12 months.

Market-beating complete returns with comparatively low volatility

One sector notably absent from Robinhood’s Prime 100 record — each in inventory and ETF kind — is actual property. There are just a few good causes Robinhood traders may wish to change that. First, actual property shares are typically much less risky than the remainder of the market and may diversify a inventory portfolio.

Second, actual property shares are typically glorious dividend payers. The Vanguard Actual Property ETF (NYSEMKT: VNQ) pays three.5% as of this writing and invests in a portfolio of 181 actual property funding trusts, or REITs.

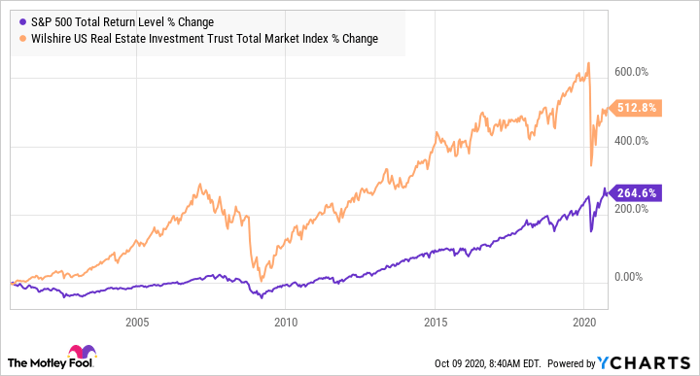

Lastly, whereas many traders consider actual property as a boring and low-return funding, that is a whole false impression. In truth, over the previous 20 years, actual property funding trusts have produced higher complete returns than the S&P 500.

^SPXTR information by YCharts

It is also price mentioning that many dividend-focused ETFs, just like the Vanguard Excessive Dividend ETF talked about earlier, particularly exclude actual property shares, so each might be glorious additions to your long-term funding technique.

10 shares we like higher than Vanguard Excessive Dividend Yield ETF

When investing geniuses David and Tom Gardner have a inventory tip, it may pay to hear. In spite of everything, the e-newsletter they’ve run for over a decade, Motley Idiot Inventory Advisor, has tripled the market.*

David and Tom simply revealed what they imagine are the ten greatest shares for traders to purchase proper now… and Vanguard Excessive Dividend Yield ETF wasn’t one in all them! That is proper — they assume these 10 shares are even higher buys.

See the 10 shares

*Inventory Advisor returns as of September 24, 2020

Matthew Frankel, CFP owns shares of Sq. and has the next choices: quick September 2022 $155 calls on Sq.. The Motley Idiot owns shares of and recommends Intuit, PayPal Holdings, Sq., Tesla, Vanguard REIT ETF, and Virgin Galactic Holdings Inc. The Motley Idiot owns shares of Vanguard Excessive Dividend Yield ETF. The Motley Idiot recommends Johnson & Johnson and recommends the next choices: lengthy January 2022 $75 calls on PayPal Holdings. The Motley Idiot has a disclosure coverage.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

[ad_2]

Source link