[ad_1]

October 5, 2020

Timothy Prickett Morgan

The biggest public clouds on the planet are additionally among the many most secretive and influential corporations within the IT sector, and due to this fact regardless of occasions that go one for days or, now within the time of coronavirus, for weeks on finish, we get little or no precise info out of them about particularly what’s going on within the cloud market with any quantity of specificity.

Sure, everyone and anyone who’s an incumbent within the IT sector talks about how their “cloud” enterprise is doing, and at the least one of many huge IT market researchers is kind of throwing up its fingers in making an attempt to delineate the revenues from the several types of cloud companies that the large suppliers ship. It takes a very long time to get numbers that make sense, and the Tremendous eight will not be precisely cooperative in vetting the numbers. We’re speaking about Gartner, in fact, who stated in a latest report that cased the gross sales of infrastructure as a service (IaaS) clouds in 2018 and 2019 – sure, there may be that sort of lag within the knowledge – that it could be combining IaaS revenues and platform as a service (PaaS) revenues going ahead right into a single class referred to as cloud infrastructure and platform companies, or CIPS for brief.

Gartner reckons that this general class grew by 43.2 p.c in 2019, reaching $63.four billion worldwide in opposition to gross sales of $44.6 billion. The IaaS section, which Gartner was teasing about in its press launch and what caught our consideration initially, rose by 37.three p.c, from $32.four billion in 2018 to $44.5 billion in 2019. There’s a sure logic to what Gartner is doing, for the reason that platform service often consists of the underlying infrastructure, however there may be additionally a price in understanding what prospects are simply shopping for the uncooked infrastructure.

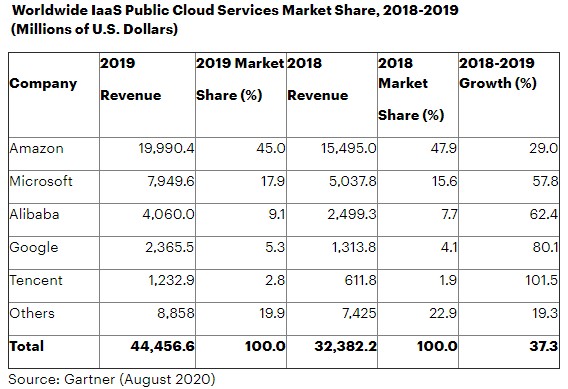

Right here is the breakdown by vendor for 2019 and 2018, the place the highest 5 gamers account for roughly four-fifths of the revenues worldwide for IaaS:

Clearly, Amazon Internet Providers has the biggest a part of the IaaS market on the general public clouds, with a shocking 45 p.c market share in 2019 with only a tad beneath $20 billion in revenues and 29 p.c progress. AWS is beginning to hit the restrict of huge numbers and the restrict of market share results, and since its progress is slower than the IaaS market, AWS really misplaced market share although it grew at a fee that a server maker envies. Microsoft and Alibaba grew roughly twice as quick in IaaS, and Microsoft was approaching half the dimensions of AWS in IaaS and can most likely be capable of break via $12 billion in 2020 if all developments persist, getting nearer and nearer to AWS. Alibaba owns a dominant place in cloud in China, and there’s no purpose to anticipate that it can’t develop to rival AWS in dimension finally. Google performs third fiddle to AWS and Microsoft in North America and Europe, however had 80.1 p.c progress to achieve $2.37 billion in gross sales in 2019, and if progress persists it ought to break $four billion in gross sales in 2020 for IaaS. Some issues should change out there for Google to ever catch AWS or Microsoft. Tencent is equally being scrappy and making an attempt to tackle Alibaba within the Chinese language market, but it surely has a protracted method to go along with solely $1.23 billion in gross sales in 2019. The remainder of the market, which has dozens and dozens of gamers, grew by 19.three p.c in 2019, to $eight.59 billion, and solely accounted for just below 20 p.c share. This can be a quantity recreation, and it’ll keep that manner.

Now, whereas Gartner says it is going to be combining IaaS and PaaS revenues into that single class referred to as CIPS going ahead, the most recent forecasts nonetheless break whole cloud companies into the 5 classes all of us acknowledge at this level. Have a look:

As you may see, Gartner expects for IaaS to continue to grow at a well being clip within the subsequent three years, though the expansion fee did take a dip at solely 13.four p.c anticipated this tear regardless of the entire discuss to transferring to the cloud. The fascinating bit for us is that enterprise course of as a service, or BPaaS, was bigger than IaaS and PaaS individually, Additionally, if you happen to add the PaaS and IaaS numbers from this forecast, accomplished in July 2020, they’re much bigger than the revenues cited within the IaaS mannequin that Gartner put out in August that we referred to above. Go determine. We additionally see that desktop as a service, or DaaS, continues to be nascent and never anticipated to be a lot of a slice of cloud infrastructure, however it’s rising quick as a way of supporting distant employees.

RELATED STORIES

Non-public Cloud Spending Regular, Public Cloud Declines

Conventional IT Spending Bests Cloud Infrastructure, For Now

Huge Blue Lastly Brings IBM i To Its Personal Public Cloud

Public Cloud Dreaming For IBM i

Skytap Says It’s Constructing a ‘True Cloud’ Providing for IBM i

A Higher Manner To Pores and skin The IBM i Cloud Cat

What Cloud Suppliers Should Do To Entice IBM i

Google Near Launching IBM i Cloud Service, Will Says

Is The ‘Golden Age’ of Computing Leaving IBM i Behind?

Ensono Emerges With IBM i Cloud Providing

Clouds Develop, However Can IBM i Observe?

IBM i Tries On a Pink Hat

Seiden Group Helps Convey Group PHP To The Japanese Market

[ad_2]

Source link