[ad_1]

This text will mirror on the compensation paid to Tony Rovira who has served as CEO of Azure Minerals Restricted (ASX:AZS) since 2003. This evaluation can even assess whether or not Azure Minerals pays its CEO appropriately, contemplating latest earnings development and whole shareholder returns.

Try our newest evaluation for Azure Minerals

How Does Complete Compensation For Tony Rovira Evaluate With Different Firms In The Trade?

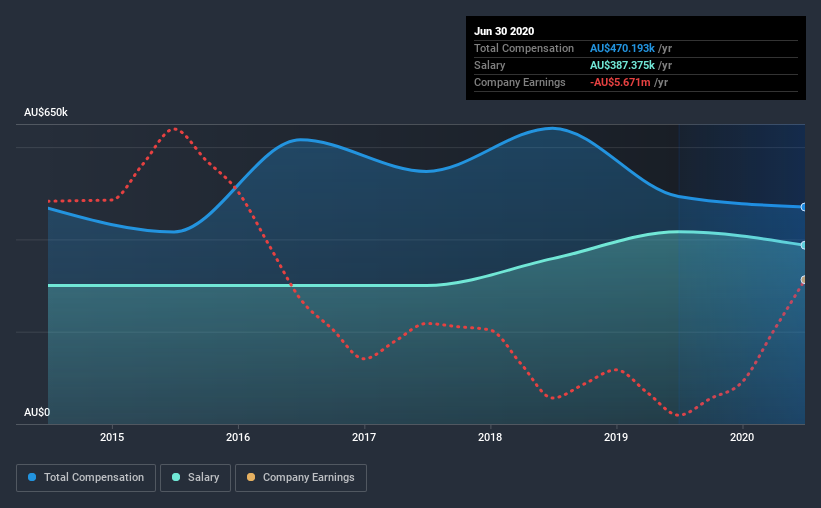

In accordance with our knowledge, Azure Minerals Restricted has a market capitalization of AU$42m, and paid its CEO whole annual compensation value AU$470okay over the yr to June 2020. That’s a slight lower of four.6% on the prior yr. Notably, the wage which is AU$387.4k, represents many of the whole compensation being paid.

On evaluating similar-sized firms within the trade with market capitalizations beneath AU$285m, we discovered that the median whole CEO compensation was AU$308okay. This means that Tony Rovira is paid greater than the median for the trade. Furthermore, Tony Rovira additionally holds AU$141okay value of Azure Minerals inventory immediately underneath their very own identify.

| Element | 2020 | 2019 | Proportion (2020) |

| Wage | AU$387okay | AU$417okay | 82% |

| Different | AU$83okay | AU$76okay | 18% |

| Complete Compensation | AU$470okay | AU$493okay | 100% |

Speaking when it comes to the trade, wage represented roughly 68% of whole compensation out of all the businesses we analyzed, whereas different remuneration made up 32% of the pie. It’s fascinating to notice that Azure Minerals pays out a higher portion of remuneration by way of wage, in comparison with the trade. If whole compensation veers in the direction of wage, it means that the variable portion – which is mostly tied to efficiency, is decrease.

A Take a look at Azure Minerals Restricted’s Development Numbers

Azure Minerals Restricted has seen its earnings per share (EPS) improve by 16% a yr over the previous three years. It achieved income development of 139% over the past yr.

General it is a constructive outcome for shareholders, exhibiting that the corporate has improved in recent times. The mix of sturdy income development with medium-term EPS enchancment actually factors to the sort of development we wish to see. We don’t have analyst forecasts, however you would get a greater understanding of its development by trying out this extra detailed historic graph of earnings, income and money movement.

Has Azure Minerals Restricted Been A Good Funding?

Since shareholders would have misplaced about 49% over three years, some Azure Minerals Restricted traders would certainly be feeling damaging feelings. This means it could be unwise for the corporate to pay the CEO too generously.

In Abstract…

As we famous earlier, Azure Minerals pays its CEO greater than the norm for similar-sized firms belonging to the identical trade. Nevertheless, the EPS development is actually spectacular, however shareholder returns — over the identical interval — have been disappointing. Contemplating general efficiency, we will’t say Tony is underpaid, in actual fact compensation is certainly on the upper aspect.

CEO pay is just one of many many components that should be thought of whereas inspecting enterprise efficiency. That’s why we did our analysis, and recognized 5 warning indicators for Azure Minerals (of which three are vital!) that you need to find out about so as to have a holistic understanding of the inventory.

In fact, you may discover a incredible funding by taking a look at a distinct set of shares. So take a peek at this free listing of fascinating firms.

Promoted

If you happen to resolve to commerce Azure Minerals, use the lowest-cost* platform that’s rated #1 General by Barron’s, Interactive Brokers. Commerce shares, choices, futures, foreign exchange, bonds and funds on 135 markets, all from a single built-in account.

This text by Merely Wall St is normal in nature. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by elementary knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

*Interactive Brokers Rated Lowest Value Dealer by StockBrokers.com Annual On-line Overview 2020

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team@simplywallst.com.

[ad_2]

Source link