[ad_1]

Amazon (AMZN) is now a cloud firm via AWS (Amazon Net Companies), and the expansion behind this all-important enterprise would be the driver that is wanted to take the corporate over a $2T market capitalization.

Traders who’re creating valuation fashions primarily based on the whole thing of Amazon’s gross sales (P/S), earnings (P/E), and even free money movement (via firm-wide DCFs), are lacking the purpose. AWS is probably the most thrilling characteristic of the enterprise and its potential long-term progress potential. As such, it must be adopted carefully by Amazon traders, significantly as a result of there’s a lot progress taking place within the cloud IT infrastructure trade as we speak, accelerated much more so by the COVID-19 disaster.

For 2020, AWS is set-up for a $2.3B windfall in working earnings, one that’s indicative of each a know-how win and longer-term sustained working revenue progress for this hyperscaled progress enterprise phase.

However this $2.3B windfall, which ends up in a major enhance in sum-of-the-parts valuation for AWS and Amazon, is barely evident to prudent traders who’re taking note of the (PPE) accounting developments happening with the corporate, extra so than any technological buzzwords than you may usually hear with discussions about a few of the largest suppliers of the cloud trade, like Intel (INTC), AMD (AMD), or Cisco (CSCO), or Amazon’s cloud opponents, like Microsoft’s Azure (MSFT) or Google’s Google Cloud (NASDAQ:GOOG) (GOOGL).

I talked about how The Cloud Has Ceaselessly Modified PPE Accounting in a earlier article, and it is as a result of information wants a bodily residence and massive capital funding to help it. Some pertinent statistics and factors I made:

Between these firms and plenty of extra, the use of information is employed from advertising, to administration of prices, to efficiencies in manufacturing and distribution, to computer-assisted options, to content material consumption, to in every single place in between.

All of this information wants a spot to be saved, and that requires costly gear for big information servers and networking– and that requires many kinds of computer systems and digital elements that have to be steadily maintained and changed.

A current report estimated that each particular person in 2020 will generate 1.7 MB of information in simply 1 second, which might be 86.four GB in 24 hours, by the way in which.

Netflix (NFLX), with its massive volumes of heavy data-intensive video information, estimates it saves $1 billion by retaining prospects from massive information!

We’re simply getting began in terms of PPE accounting as the premise behind valuation fashions and earnings and capex estimates, and I extremely advocate testing my piece in case you are .

Amazon’s Expertise Wins for 2020

The corporate’s newest earnings launch was so jam-packed with developments that even Jeff Bezos referenced it as “one other extremely uncommon quarter.” It is very attainable that a lot of this hasn’t been totally digested by traders and analysts, as we nonetheless look on in awe on the insane progress charges and market capitalization that continues to push into the stratosphere.

This was with the announcement that the COVID-19 lockdowns took Amazon’s Working Revenue from $7,504 million within the Six Months Ended June 30, 2019 to $9,832 million within the Six Months Ended June 30, 2020 (a 31% enhance YOY). In response to the corporate’s newest earnings press launch, they nonetheless:

“Even on this unpredictable time, we injected vital cash into the economic system this quarter, investing over $9 billion in capital initiatives, together with success, transportation, and AWS.”

This could make cloud community distributors perk up (speaking to you, Intel and AMD traders), because the introduced capex reveals that the funding in networking and server gear has not solely not slowed down for this largest cloud hyperscaler, however accelerated significantly. (Final 12 months the corporate spent $16.86B in PPE purchases, and taking the current quarter’s $9B spend and multiplying it by four signifies an enormous enhance).

As if the announcement of a stellar quarter wasn’t sufficient, the corporate additionally introduced the next wins for AWS:

“HSBC, one of many world’s largest monetary providers organizations, chosen AWS as a key, long-term strategic cloud supplier to drive their digital transformation and ship new and personalised banking providers for tens of millions of non-public banking prospects worldwide.”

“International market intelligence firm IHS Markit chosen AWS as its most popular cloud supplier to assist enhance scalability and agility to answer trade modifications and develop new services.”

To not point out scoring different massive names:

- Formulation 1

- Bundeslinga

- Capella House

- Genesys

Nevertheless, in probably dangerous information for Intel and AMD, the corporate additionally introduced this know-how win:

AWS introduced the final availability of the sixth era of Amazon Elastic Compute Cloud (Amazon EC2) with three Arm-based cases (M6g, C6g, R6g) powered by AWS-designed, Arm-based Graviton2 processors, that ship as much as 40% higher worth and efficiency than present x86 processor-based cases.

This vertical integration technique that Amazon is taking over with AWS, from utilizing white field networking gear and a novel 25 GbE strategy, to this foray into CPUs, does strike worry into your entire trade. Nevertheless, as I relayed within the Cloud PPE Accounting publish above, this vertical integration nonetheless has real-world bodily constraints which might be extra restrictive than the scalability of software program, for instance.

Between the variations in vertical integration technique for this massive information heart build-outs, from Amazon’s use of Broadcom’s (AVGO) ICs in 25 GbE, to Microsoft and Fb’s (FB) use of Arista Networks’ (ANET) distinctive EOS networking gear/software program hybrid, to Google Cloud’s partnership with Cisco (CSCO), the chances behind earnings and winners and losers is so vastly advanced. Which is why this PPE accounting transfer has implications not only for AWS, but in addition community and information heart suppliers – even these like IBM (IBM), Dell EMC (DELL), HPE Aruba (HPE), HP Inc. (HPQ), and others.

Amazon’s PPE Accounting Change for 2020

In slightly hidden facet word in Amazon’s newest 10-Ok, the corporate revealed that they’re updating the helpful life for his or her servers from three years to four years, which can end in a $2.3B enhance in working revenue for AWS in 2020.

From Be aware 1 – Description of Enterprise and Accounting Insurance policies (daring emphasis mine):

For instance, in This autumn 2019 we accomplished a helpful life research for our servers and are rising the helpful life from three years to 4 years for servers in January 2020, which, primarily based on servers which might be included in “Property and gear, internet” as of December 31, 2019, can have an anticipated impression to our 2020 working revenue of $2.three billion.

The rationale for this was that depreciation will now be unfold out over an extra 12 months. As I discussed in my Cloud PPE Accounting publish, although depreciation shouldn’t be a money expense, it’s an expense within the revenue assertion, and so the impact of lengthening the PPE helpful life shall be to stretch the depreciation over an extra 12 months, which does not sound like rather a lot however is mostly a 33% extension, therefore the $2.3B in further working revenue.

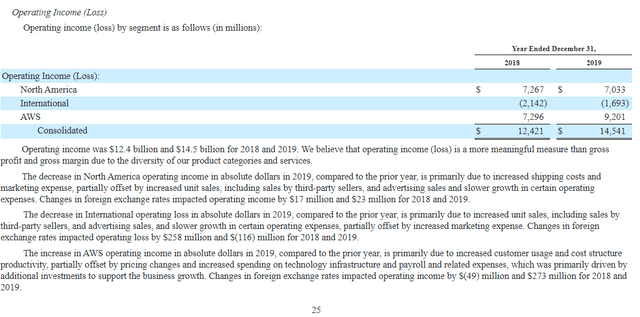

How this might impression an already extremely profitable state of affairs for Amazon’s AWS phase might be illustrated fairly merely:

With an natural enhance final 12 months of 26.1% YoY in working revenue for AWS, which is already probably the most worthwhile phase, the additional $2.3B would deliver working revenue to $11.5B, not together with the stellar outcomes for Q2 I indicated above. A 25% progress in working revenue just by bettering the tech of their huge information servers community is a catalyst that would not solely proceed (from four years to five years after which later), but in addition present a vital aggressive benefit if these technological enhancements keep in-house.

With an natural enhance final 12 months of 26.1% YoY in working revenue for AWS, which is already probably the most worthwhile phase, the additional $2.3B would deliver working revenue to $11.5B, not together with the stellar outcomes for Q2 I indicated above. A 25% progress in working revenue just by bettering the tech of their huge information servers community is a catalyst that would not solely proceed (from four years to five years after which later), but in addition present a vital aggressive benefit if these technological enhancements keep in-house.

Assuming that the quarterly outcomes did not embrace this PPE accounting replace, of which there was no point out of PPE or information facilities within the newest information launch, we may simply be an working revenue (taking Q2’s stellar outcomes under consideration) enhance of 45% or larger YOY.

Be aware: To return at that estimate, I merely took Q2’s working revenue enhance, multiplied by 2, and added the $2.3B windfall to give you round a $7B enhance in complete working revenue for the 12 months, in comparison with $14.5B in 2019.

AWS/Cloud Complete Addressable Market, Which May Additionally Swallow Conventional Servers and Distributors

Since AWS is undoubtedly the very best progress phase of the corporate, and has already surpassed the retail segments in working earnings for two years operating, it is affordable to estimate a valuation of Amazon primarily based on this phase and its excessive progress potential moderately than the expansion potential of your entire enterprise, with the retail phase going through a lot larger ranges of saturation and a ceiling to the expansion of Amazon Prime.

The scope of the chances for market share for AWS lengthen a lot additional than simply the normal “bricks and mortar” components of IT infrastructure comparable to information servers for compute and storage, as you’ve got so many types of software program, platforms, safety, analytics, and different use circumstances and attainable providers revenues, and the market itself is hard to challenge or quantify.

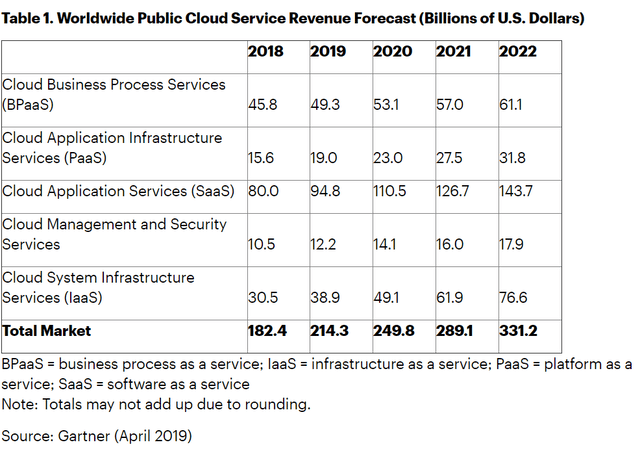

Gartner has a pleasant forecast for the Worldwide Cloud Companies trade as a complete (with exponential progress via 2022 anticipated, I’d add):

Someplace between the $250-350B market measurement as the present TAM estimate does not appear unreasonable, and AWS ought to have a giant piece of that pie whether or not via finish use varieties comparable to PaaS, SaaS, or IaaS (as the corporate will get positioned in a pure place to market further providers and options to current prospects).

Someplace between the $250-350B market measurement as the present TAM estimate does not appear unreasonable, and AWS ought to have a giant piece of that pie whether or not via finish use varieties comparable to PaaS, SaaS, or IaaS (as the corporate will get positioned in a pure place to market further providers and options to current prospects).

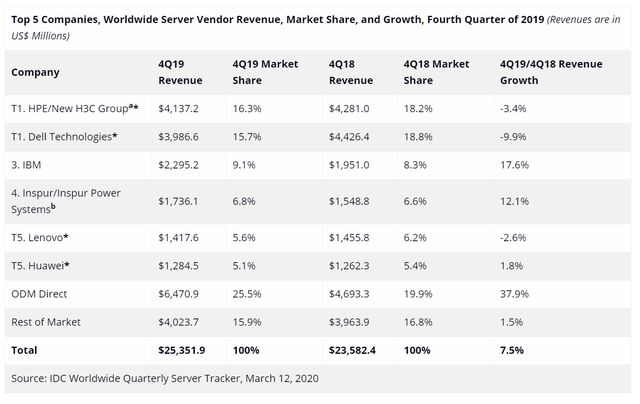

And then you definitely even have the Worldwide Server Market distributors market evaluation by IDC, who might be completely eaten by the transfer to cloud computing over conventional campus servers – and naturally subsequently, AWS. For now, conventional servers are nonetheless rising because the machines do have their particular benefits and features and cloud computing progress is proscribed by bodily capacities, community hundreds, software program or platform limitations, and many others.

these quarterly figures and multiplying by four signifies someplace round a $100B market. You may see the leaders HPE and Dell are experiencing shrinking market share and revenues, which lends doubt to the energy of these opponents in comparison with the dominance and ridiculous progress skilled by cloud computing friends Amazon and Azure.

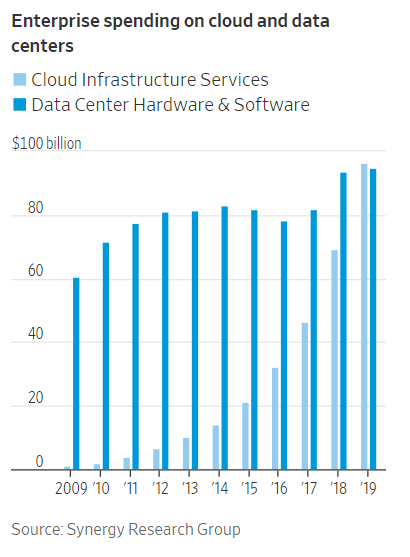

To provide yet one more visible context level on the variations between the 2 markets, and why cloud computing will in all probability eat this market over the long run, this chart by the Wall Avenue Journal says all of it:

All of this to say, I believe an affordable TAM (Complete Addressable Market) for AWS may roughly embrace the sum of those two markets, although I doubt the disappearance totally of Knowledge Middle Hardware & Software program, much like how the emergence of the laptop computer did not totally unseat the desktop or workstation pc within the PC market.

All of this to say, I believe an affordable TAM (Complete Addressable Market) for AWS may roughly embrace the sum of those two markets, although I doubt the disappearance totally of Knowledge Middle Hardware & Software program, much like how the emergence of the laptop computer did not totally unseat the desktop or workstation pc within the PC market.

This implies a TAM as we speak for the mixed Cloud Infrastructure Companies + Knowledge Facilities market of one thing like $400B, with $800B in 10 years not too far out of the vary of potentialities (7% CAGR), which shall be helpful for our DCF valuation estimate beneath.

Valuation Implications – The AWS Enterprise

Evaluate these market figures with the present income and developments for the AWS phase and also you see an trade that’s ripe for the choosing, and nonetheless early by way of AWS’s potential to swallow swathes of it.

The underside line is that AWS may actually develop into one thing like a 40% market share of the mixed Cloud Infrastructure Companies + Knowledge Facilities market of $800B in 10 years, which might roughly come to one thing like $320B in income. In fact, these are wildly imprecise measurements, however the level stays that loads of progress may nonetheless be on the desk, and that is even ignoring the extraordinarily engaging potentialities of a continued exponential progress of the trade as a complete and/or a better than 40% market share for AWS within the mature stage of the trade life cycle.

The underside line is that AWS may actually develop into one thing like a 40% market share of the mixed Cloud Infrastructure Companies + Knowledge Facilities market of $800B in 10 years, which might roughly come to one thing like $320B in income. In fact, these are wildly imprecise measurements, however the level stays that loads of progress may nonetheless be on the desk, and that is even ignoring the extraordinarily engaging potentialities of a continued exponential progress of the trade as a complete and/or a better than 40% market share for AWS within the mature stage of the trade life cycle.

Within the try and be vaguely appropriate moderately than exactly flawed, let’s challenge a 25% progress charge for the working phase of AWS. In contrast with the historic achievements of the enterprise, and the prevalence of COVID-19 accelerating the expansion of the cloud trade as a complete, to not point out the numerous value financial savings applied by AWS’s know-how wins (comparable to this $2.three billion revenue acquire from the PPE adjustment), 25% won’t be a loopy progress estimate for this enterprise – and I can not imagine that is popping out of my mouth (properly, within the type of textual content for you).

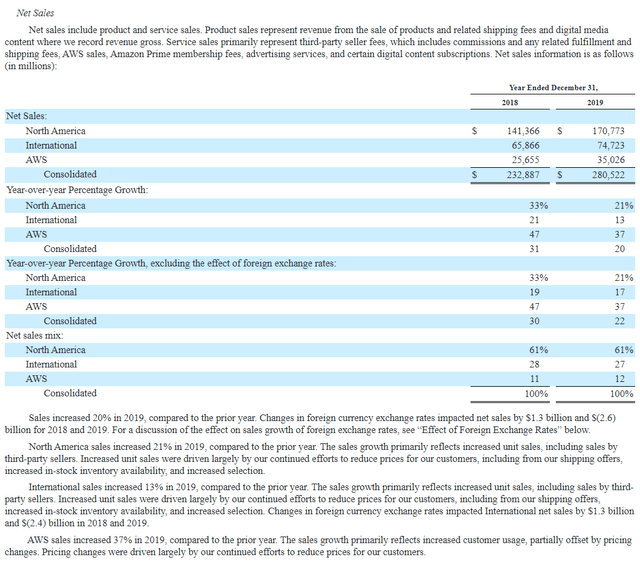

Taking 25% progress over a 5-year interval on the revenues for AWS as we speak ($35,026) utilizing a compound curiosity calculator would put revenues in 5 years at $106B, which falls properly beneath the attainable market place primarily based on the beautiful conservative assumptions made above. So, and once more I can not imagine I am saying this, projecting 25% working revenue progress over 5 years for valuation functions on an organization with a present market cap of over $1.5T won’t be as loopy because it sounds, and in reality may even be very conservative for this fast-moving rocket we name AWS.

Placing income progress at 25% CAGR for 10 years (extra in-line with conventional DCF fashions) would put AWS income at $326B, which might fall proper in-line with the 40% market share estimate of $320B in income for the mixed TAM mentioned above.

The DCF Mannequin Inputs for a Valuation for AWS

To give you an affordable FCF estimate for AWS, I will err on the facet of conservative and vaguely appropriate by subtracting capex (PPE adjustment clued us in that $2.3B over four years = $9.2B in PPE depreciation) from AWS working revenue (with the perpetual $2.3B in working revenue bump from improved server PPE life).

Then, utilizing a DCF valuation, I am going to use the FCF estimate with the 25% progress estimate to give you a valuation estimate for the AWS enterprise all by itself. For terminal progress charge, I will use the present progress charge for normal IT providers, which is roughly 7% and will characterize the expansion of cloud providers as they mature and presumably unseat conventional IT utterly.

- Potential AWS Capex roughly $9.2B

- AWS projected 2020 Working Revenue = $13.8B

- AWS attainable FCF estimate for DCF mannequin = $four.6B

- AWS attainable FCF progress estimate for DCF = 25%

- AWS attainable FCF terminal progress for DCF = 7%

- AWS attainable low cost charge = 6% (weight common value of fairness = 97%, assume a long run beta that begins to strategy 1.zero)

- FCF / share calculated by taking half of diluted shares excellent (representing half of AMZN’s complete valuation)

Utilizing these tough inputs leaves an FCF/share estimate of $18.25 for AWS alone, resulting in a DCF valuation estimate for AWS of $1,504.08 truthful worth per share. This may put AWS at 45.7% of Amazon’s present valuation (share worth near $3300), which may lend credence to the argument that the corporate is presently pretty valued if the remainder of the retail enterprise precisely makes up the remaining valuation at truthful worth.

***If you would like extra deep dives into firm filings like this one, please do take into account Following my profile with electronic mail alerts.***

Disclosure: I’m/we’re lengthy CSCO. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (apart from from Looking for Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.

[ad_2]

Source link